Managing the unforeseeable

If the four men in the site management hut looked out the window, they would enjoy an impressive view: six yellow cranes and hundreds of men are working on a mighty building project. Wherever you look there’s something going on. In the foreground the Helvetia Tower is taking shape. When finished it will be 75 metres high, the symbol of the Vierfeld project and the tallest building in Pratteln near Basel. But the men don’t give the bustle of activity a glance, staring instead at the wall on which a seemingly endless series of figures is being projected.

Just next to Pratteln station Implenia is building six buildings on four plots. When these are finished in autumn 2016 they will provide 300 homes plus commercial space. The multifaceted project also includes a retirement and care home as well as sheltered housing for the aged. The Helvetia Tower will soon be giving residents a unique view over the Rhine plain, while its three lower floors offer space for services, offices, practice premises, cafes and shops. A public square is being laid in front of the building.

The men buried in figures in the hut don’t need to look at the building site because they already know this project like the backs of their hands. Project managers Philipp Hauri and Rainer Kaiser, and overall project manager for Vierfeld Philip Woolley are discussing the latest status of the project with Andreas Beier, Head of Risk Management at the Buildings Business Unit.

Philip Woolley is currently talking about the opportunity to do a “tenant fit-out”. The original plan was for Implenia to hand over the commercial spaces as empty shells, but an opportunity originally identified when initial calculations were being made has now become a real possibility. Discussions about Implenia doing the interior fittings for a future tenant are already far advanced. On the basis of this new information, Rainer Kaiser, sitting at his laptop, adjusts the status in Risktool, an application developed by Implenia to assist with opportunity and risk management.

The company has built up its systematic risk management over the last two years, and by the end of 2013 had trained 244 employees how to use Risktool. Vierfeld is the first project in the Basel Region to make use of the new opportunity and risk management system. Daniel Reber and his team did the calculations for the project. The qualified construction cost planner and Head of Calculations has many years of experience. When Implenia Buildings offers the Basel office a project, the documentation tends to end up on Reber’s desk. He measures out the plans and calculates an overall price for all the building work involved. In just a few weeks he has to turn a flood of information into a binding offer. It is a very responsible job.

At Implenia, risk management covers the six stages of a project, from acquisition to guarantee and for each stage there is a list of questions. In order to answer the questions relating to the calculation stage for Vierfeld, Daniel Reber rummaged through the client’s documents and did further research where anything was unclear. He then distilled around 20 opportunities and risks from the project and entered them in Risktool. One of these was the opportunity for a tenant fit-out. “The programme forces you to think about things that can fall by the wayside in conventional planning,” says Reber. In particular, Risktool asks for well-defined measures and figures to accompany each opportunity or risk.

The calculation stage is the most important stage in risk management. This is what decides whether the opportunities and risks are correctly assessed. “It takes time before you fully understand the method and know the programme,” Reber admits, “but it’s vital you do.” It has become second nature for Reber now – he has already processed ten projects with it and discovered many benefits: “It’s nice to be able to delegate responsibility by showing where the risks are.” Reber can be sure that when the project is being carried out, someone is taking charge of the opportunities and risks he has identified. This systematic procedure takes some of the burden from the calculators’ shoulders.

Back to the hut, where the discussion continues about the electronic risk journal compiled by Daniel Reber some months ago. “I’m very happy with how much work has been done on the tenant fit-out idea in the meantime,” says Andreas Beier. As well as updating the status, the financial side of the opportunity now has to be reassessed. Daniel Reber had entered estimated figures for the possible scenarios. The men in Pratteln agree that these numbers still add up. This completes entry number 15 in the risk journal, leading to the next point of discussion – a risk.

PUTTING RISK INTO FIGURES

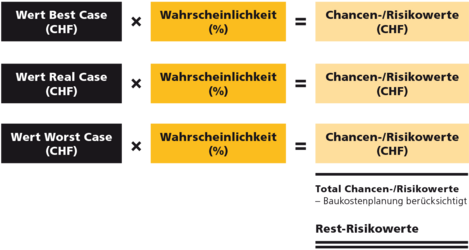

Implenia gives each identified risk (and each opportunity) three descriptions: The Best Case and the Worst Case are self-explanatory. The Real Case is the scenario most likely to happen. The cost accountant fleshes out the specific technical details for each scenario and calculates the costs. In a second step the three scenarios are given a probability factor: how likely they are to happen. The risk management tool calculates the expected benefits or losses by multiplying the costs of the three scenarios by the probability factor and adding them all up. This “RC” value is the key benchmark figure in risk management.

“We usually review the risk evaluation as part of the monthly project management round-up,” explains project manager Philipp Hauri, “so the costs are always clear to us”. Which is a big benefit. “The enormous advance is that we on the construction site have constant access to all the information produced by our colleagues in the Calculation department,” adds his colleague Rainer Kaiser. “Nothing gets lost between the cracks, and you don’t have to scrabble around for information.” The important information is right there on the table rather than locked in people’s heads, so work can begin as soon as the order comes in. With deadlines getting ever tighter, this is a big advantage.

Overall project manager Philip Woolley agrees: “Opportunities and risks have always played a role, but the new method provides us with a clear and systematic way of recording and showing them. Given the tight contractual corset there is around many projects, nothing can be left to chance. For me as the person with overall responsibility for the project, the tool give me a certain reassurance. It is simply one of those standardised processes that a major company needs to have. We can’t just rely on good luck and hope that the numbers add up at the end.”

EXAMPLES OF KNOWN RISKS

- Late delivery penalties

- The critical effect of weather on the construction industry

- Exchange rate risks on foreign currency payments

- Complexity of the building work

- Building while operations continue

EXAMPLES OF UNKNOWN RISKS

- Prototypes or special structures, e.g. for facades or building technology

- New materials and processes

- Coincidence of different standard processes and methods that are robust on their own but that lead to problems when combined

- Subcontractors going bust