From compliance to opportunity: Transformative strategies for value creation

An intensified commitment to sustainability in Europe, driven mainly by the Paris climate agreement and EU taxonomy, has put the real estate industry under pressure to implement significant transformation. The recently revised Energy Performance of Buildings Directive (EPBD) and the Energy Efficiency Directive (EED) envisage a highly energy efficient and decarbonised building stock (a defacto zero-emission building stock) by 2050, and at least a 55% reduction in greenhouse gas emissions (compared to 1990) by 2030 (source). In response to these directives, the European Union has set a target of renovating 25% of the most energy-inefficient properties within its member states by 2033. Additionally, starting from 2030, all new builds must meet strict emission-free criteria with regard to both the manufacture and disposal of construction materials. Furthermore, the EU plans to phase out the use of fossil fuel-based heating by 2040 (source).

The regulatory framework in Switzerland is less developed, but the country has made a strong commitment to climate goals by adopting the Federal Council’s long-term climate strategy (2021) and passing the "Climate and Innovation Act" (2023), which established a net-zero target. Given the significant contribution of the real estate and construction sector to primary energy consumption (36%) and greenhouse gas emissions (37%), the sector has rightly been put under the spotlight by civil society and political decision-makers as they seek to reduce global carbon emissions and achieve the Paris Agreement’s 1.5-degree target by 2050. Decarbonisation must therefore be prioritised in the development, construction, and management of real estate.

This evolving regulatory framework is particularly critical for asset managers and banks, because properties that fail to meet new standards increasingly risk becoming 'stranded assets' (reduced fungibility, style/risk shift). To prevent this happening, owners often have to allocate significant funds to renovation in order to meet new energy and social standards, and avoid “brown discounts”. We believe that ESG-conformity will soon be “the new normal”, meaning that assets that fail to meet a certain rating will be discounted - rather than those that fulfil ESG requirements attracting a premium. Taking the German office market as example, up to 69% (€ 303 bn) of all Top-7 office properties are at risk of becoming stranded, according to Colliers.

«The push towards a sustainable building stock is not just a compliance exercise but a strategic opportunity to redefine Real Estate portfolio management.»

Armin Hafner, CAIA

Team Lead Real Estate Investment

Stranded assets within investment styles

Practitioners and academics usually classify real estate properties according to their risk-return profiles, using the terms ‘core’, ‘value-add’ and ‘opportunistic’ as proxies for the level of predictability of future cash-flows and value development:

- Core properties are those that achieve a significant portion of their returns from current income and are characterised by rather low volatility and often lower levels of leverage. They are thus assumed to be the most liquid class even in challenging market environments.

- Value-add and to a certain degree opportunistic properties are those that are in transition and which may or may not generate active cashflows. Future cash flows are not yet stabilised owing to current conditions and are characterised by a certain (substantial) level of uncertainty. Compared to core assets, value-add assets tend to generate less current income and rely more on (future) value appreciation as a component of total returns.

In general, owners aim to improve asset characteristics by employing several strategies including physical changes/capex, repositioning, or a change in tenant mix. These approaches require active management. Successful implementation and outcome thus rely heavily on the skillset of the manager or mandated third party and their ability to successfully identify and execute measures that add true value.

UBS defines a stranded asset as one “that loses its value earlier than expected, normally because of changing economic structures […] turning previously secure investments into liabilities”. The author would add ‘regulatory structures’ to this definition and locate such assets between core and value-add, with a tendency to value-add; though a differentiation must be made according to the property type and its main characteristics (e.g. residential vs. office).

Institutionally held residential properties facing the threat of stranding in Germany or Switzerland are still cash generating, predominantly show low levels of leverage and currently enjoy small or tolerable vacancy rates in metropolitan areas. However, they could still face a short to mid-term risk of devaluation, substantial statutory obligations to make energy-efficient renovations, and reduced fungibility (up to the point of not being sellable or rentable at economically feasible prices).

In the office property sector, the risk of (future) vacancies is much higher and resilience is much lower, so there is a significantly greater overall risk of becoming stranded or even obsolete. Colliers refers to the “stranding-asset-point” – the point where there is an “unexpected” decrease in income or even a total loss of value (source).

A brief introduction to alpha

Alpha can be described as an excess (or abnormal) return on an investment relative to its benchmark as the result of active investing, which cannot be described by known factors but is due to skill or luck. If an abnormal return persists over time (abnormal return persistence) it might be an indicator of skill rather than luck.

Within a portfolio, certain alternative assets can act as alpha drivers. In general, drivers of returns include investments, products and strategies that generate the portfolio’s risk and return; these are commonly divided into beta and alpha drivers. Alpha drivers are defined by the investment strategy and seek returns unrelated to benchmark exposures. Alternative assets – including real estate (especially value add/ opportunistic) – are usually classified as alpha drivers as they rely on complex, active strategies with a low correlation to traditional asset classes.

Beta, on the other hand, is a measure of systemic risk and can serve as a benchmark in the performance evaluation of an asset, fund or portfolio. Beta drivers are exposures to market risk factors and compensate for bearing non-diversifiable market risks.

Though they appear to be two separate concepts, alpha and beta can be seen as being on a spectrum. Alpha is intensely debated in academia and between professionals (especially with regard to the presence of “true alpha” and the ability to identify it). Moreover, alpha tends to become beta (or alternative beta) over time (source).

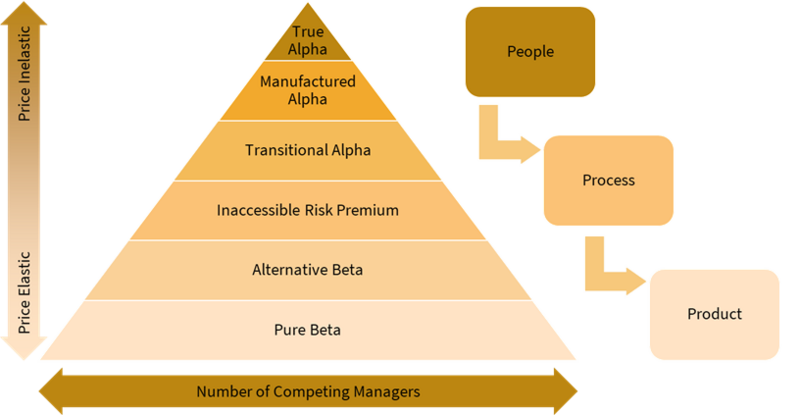

To provide a framework for the classification of investment skill, Schelling proposes a mechanism that not only aims to describe the nature and source of returns - identifying the manager’s ability to access this return stream and the probability of it continuing in the future - but that also presents investment skill as a spectrum. As the focus of this text is on real estate strategies in the context of value-add, the scope here is reduced to “manufactured alpha” (Schelling describes this as “hands-on alpha”) and “transitional alpha” (both deemed to be the most relevant in this context).

In the above hierarchy of alpha, manufactured and transitional alpha both represent alpha concepts which can be applied to the real estate industry. A movement up the pyramid reduces the pool of skilled managers able to generate the equivalent source of alpha – in our case real estate professionals with a strong skillset and experience.

Manufactured alpha entails an investor initiating an investment aimed at effecting structural or operational changes that unlock or generate value. The underlying asset can be sourced on the market or identified within a portfolio. Typically, the strategy involves repositioning the asset for resale to a buyer with a different cost of capital (as with transitional alpha as described below) or repositioning within the portfolio to increase its own portfolio performance profile. However, the difference lies in the need for the asset owner to first enhance the asset's value. Due to the operational and process-oriented nature of these strategies, managers with successful track records tend to demonstrate consistent performance. Value-add real estate is a good example of manufactured alpha generation and can apply to both greenfields and existing yielding assets that are considered stranded (e.g. change in usage type from office to residential, source).

Transitional alpha can be generated by short-term changes or specific temporary market inefficiencies. This includes situations where typical long-term owners of a specific asset (say real estate) are prevented from owning, or are forced to sell, existing assets. Such situations often result from regulatory changes – such as Basel III or, in our example, ESG related regulatory requirements. Other investors might be able to step in to hold until a repurchase is possible, or implement steps to make the asset purchasable by the previous owner. Transitional alpha can be generated from holding certain assets until natural buyers can come back and prices normalise (source).

A cumulative effect of both alphas might materialise following an improvement in revenue (rent) and/or leakage reduction (manufactured alpha), and a re-classification as core, which would lead to risk reduction with a reduced risk margin – resulting in lower discount rates/higher multiples and an expanded investor pool (transitional alpha).

As highlighted in our Real Estate blog, a central question that institutional investors face in the context of portfolio optimisation is whether they should invest in energy-efficient renovations, revitalisations or repositionings of existing properties, or whether divestment, i.e. the sale of stranded assets or brownfields, is more advantageous. This is a particular concern for Swiss pension funds that have already fully allocated their real estate quota and mostly exceed the maximum of 30% - an especially sensitive situation given that within the observed sample, most investors have invested less than 10% of their total real estate allocation in sustainable properties.

If properties are at risk of disposal, a possible strategy can be to engage managers who are good at executing sustainable ESG-compliant renovations and/or revitalisations (“Destrandification”) or formulating appropriate strategies, including carve-outs, green development and re-integration into the portfolio.

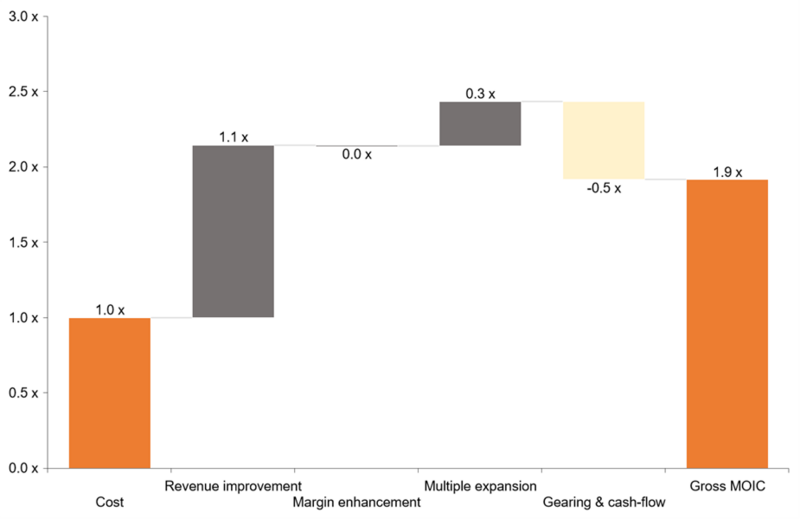

If a manager or trusted party has such a skillset, property values can be enhanced through factors such as revenue improvement (e.g. via market repositioning and increasing rent), margin enhancement (e.g. via leakage reduction), multiple expansion (e.g. via a risk shift back to core), and gearing & cash-flow (including net debt effect and cash-flow related items such as interim rents).

Practical application

The following simplified example aims to demonstrate two things: firstly the drivers for value creation and appreciation through active value enhancement via execution, and secondly the effects of transitioning on risk (as reflected in yield and multiple). Please note the sample is exemplary and fictitious – we also assume no changes in market rent or underlying interest rates. However, value ratios and overall assumptions are derived from actual projects and current market conditions.

Generating value by implementing effective and efficient redevelopment measures based on a functional repositioning (office to residential) requires a certain set of skills and experience.

Situation and assumptions:

- Acquisition of an office/commercial property (hereinafter “office”) in a major Swiss city in time T0. Good micro location with moderate to good property quality.

- Office suffers from vacancy of 20.0% with remaining main tenants having a WALT (Weighted Average Lease Term) of <24 months.

- We are assuming a renovation, redevelopment, and expansion project for conversion into a residential property following the expiration of the last lease agreements. The vacating process will be phased with the aim of complete vacancy within 18 months (by T2). Renovation and expansion works can commence simultaneously. These are projected to be completed by T3 and assumed to cost CHF 5,600 per m².

- In order to highlight the main points with regards to value-creation, the derivation of rents and opex/leakage assumptions are not further elaborated, but they are representative and backed by Implenia’s track record.

- For simplification purposes, we assume full occupancy upon completion and a sale by T4. The aim of this practical example is to demonstrate the value-added contributed by the manager/ executing company (i.e. manufactured alpha), as well as the positive effects of repositioning, which we intend to attribute to transitional alpha in this case.

- Further, in this simplified example we do not account for real estate taxes and assume that any debt is interest free.

- All values are per m².

Assumed timeline

| Timeline | |

| Acquisition | T0 |

| Remaining rents | T1 |

| Start of capex | T2 |

| Completion of capex | T3 |

| Occupation & Sale | T4 |

First, to be able to calculate and attribute the value or return, we propose a simple table that breaks down the main drivers. We use two points in time to make our comparison:

- The Entry (office) point (T0); and

- The Exit (residential) point (T4).

The situation can thus be summarised as follows:

Main value drivers and assumptions

| Component | Office Entry | Residential Exit | (Notes) |

| PGI in CHF p.a./m² | 260 | 450 | (1) |

| PGI in CHF p.m./m² | 22 | 38 | |

| Initial Vacancy | 20.0% | 2.9% | |

| Vacancy/ est. Vacancy in % of actual GR | 4.0% | 2.9% | |

| EGI in CHF p.a./m² | 198 | 424 | (2) |

| Opex/ leakage in % of actual GR | 12.0% | 12.0% | |

| Maintenance in CHF p.a./m² | 12 | 27 | |

| NOI p.a./m² | 162 | 346 | (3) |

| NOI in % EGI | 81.9% | 81.6% | |

| Total leakage in % EGI | 18.1% | 18.4% |

Notes:

(1) PGI = Potential Gross Income;

(2) EGI = Effective Gross Income;

(3) NOI= Net Operating Income;

To calculate the equivalent indicative value of the entry and exit point (representing the acquisition and sale prices) we first need to derive a capitalisation rate that captures the risk of the initial property as acquired and the future property characteristics. Applying a simple build-up model starting from a risk-free base (10 year federal bond) we assumed a capitalisation rate (CapR) of 2.5%/2.2% and a multiple (NOI to value) of 39.4x/44.8x for office and residential respectively.

Derivation of DCR, CapR and Multiple

| Component | Office Entry | Residential Exit | (Notes) |

| Risk free | 0.7% | 0.7% | (1) |

| Risk premium | 2.0% | 2.0% | (2) |

| Object quality | 0.1% | 0.0% | (3) |

| Yield spread office | 0.2% | nill | (4) |

| Discount Rate (DCR) | 3.0% | 2.7% | |

| Constant growth rate | 0.5% | 0.5% | (5) |

| Capitalisation Rate (CapR) | 2.5% | 2.2% | (6) |

| NOI to value | 39.4 x | 44.8 x |

Notes:

(1) Source: SNB, 10YR GOV as at 26Apr24;

(2) Premium for illiquidity, location (micro/macro);

(3) Objekt quality risk premium refers to overall quality for given usage;

(4) Based on the average prime yields for Office and Residential for Zurich, Bern, Basel, Lausanne and Genf. Source: Wuestpartner (Q4 2023)

After defining the NOI to value multiple we can derive an indicative value representing a fictitious market value at entry and exit and summarise the output.

Indicative value derivation and summary of results

| Indicative value derivation | |||

| Component | Office Entry | Residential Exit | (Notes) |

| PGI in CHF p.a./m² | 198 | 424 | |

| NOI p.a./m² | 162 | 346 | |

| NOI to value | 39.4 x | 44.8 x | |

| Indicative value/m² | 6’374 | 15’517 | |

| Capex/ m² | nill | 5’600 | |

| Summary | |||

| Indicative Value in CHF/m² | 6’374 | 15’517 | |

| Debt | 3’187 | 7’759 | |

| Equity | 3’187 | 7’759 | (1) |

| Debt raio for capex | 81.6% | ||

| EGI | 198 | 424 | |

| NOI | 162 | 346 | |

| Debt to value | 0.5 x | 0.5 x | |

| Value to EGI | 32.3 x | 36.6 x | |

| Value to NOI | 39.4 x | 44.8 x | |

| NOI margin | 81.9% | 81.6% | |

| Performance | |||

| MOIC adj. for capex share and interim rental income | 1.9 x | (2) | |

| Pre-tax ROE (stabilised) | 5.1% | 4.5% | (3) |

| Pre-tax CoC (stabilised) | 5.1% | 8.2% | (4) |

| Pre-tax NIY (stabilised) | 2.5% | 2.2% | (5) |

| Pre-tax IRR, levered | 21.2% |

Notes:

(1) Equity position at Exit includes share of capex measures in excess of debt financing for capex (1 - (Capex/m² x Debt ratio));

(2) MOIC adj. for capex represents adjusted multiple as equity share of capex is treated as capital invested thus increasing the denmominator. Excess interim rental income is assumed to be distributed increasing nominator;

(3) ROE = Return on Equity, levered (NOI/ Equity);

(4) CoC = Cash on Cash yield, levered (NOI/ (Initial Equity + Capex share));

(5) NIY = Net inital yield (NOI/ indicative value)

As presented above, we can see that the Gross MOIC (Multiple on Invested Capital) amounts to 1.9x after refurbishment and consideration of interim rental income. As the MOIC represents the multiple on the invested capital, this accounts for the equity share of total capex of 18.4% in addition to the initial equity employed (increasing the denominator). The amount of debt was assumed to keep a static debt to value ratio of 0.5x. Furthermore, an assumed distribution of interim cash-flows (i.e. NOI in T1 and T2 with 100% and 50% respectively) to the investor increases the nominator. We see that our equity increases 1.9-fold after refurbishment – with the debt-level remaining static. Yields go down, which was expected as we are developing to core. However, two main questions remain:

- What factors can the return be attributed to?

- What would be the impact be on a hypothetical portfolio of similar assets?

To answer the first question, we propose using a value bridge for performance and return attribution (see below), breaking down the relevant factors into the previously defined drivers: revenue improvement (e.g. via increased rent), margin enhancement (e.g. via leakage reduction), multiple expansion (e.g. via risk shift back to core) and gearing & cash-flow.

Revenues (EGI and NOI) are increased by active repositioning and related steps, including all necessary refurbishment, marketing, and rent-roll management, so we can attribute the main value factor to revenue improvement (1.1x). This (together with margin enhancement) is reflected by manufactured alpha being highly dependent on the skill and experience of the manager or third party. The exit level property quality resembles a high standard core residential product coupled with slightly increased (compared to the entry level office building) maintenance and administration costs. There is an unchanged leakage level, so we were not able to identify a value contribution from margin enhancement. Multiple expansion as a transitional alpha factor contributes around 0.3x thanks to the transition into a lower risk/core asset with yield expectations enabling re-integration/continuous integration of the property within the core portfolio.

Some of the value increase is driven by capex, partly financed with equity, and by increasing the denominator representing the equity employed and reducing the expected MOIC”.

Looking at the scenario from a portfolio perspective based on a fictious portfolio made up of comparable assets (assumed to be all core; see below) we can see a trend towards risk reduction (standard deviation (SD)) and an increase in risk-related return (expressed as a share ratio (SR)) based on the assumption that our asset (Asset 5) is stranded at entry and refurbished at exit. For our sample purposes we relied on net initial yield as a return proxy.

Sample portfolio of all core properties

| Excess return | |||||

| Asset | Entry | Exit | rf | Entry | Exit |

| Asset 1 | 2.0% | 2.0% | 0.7% | 1.3% | 1.3% |

| Asset 2 | 2.2% | 2.2% | 0.7% | 1.5% | 1.5% |

| Asset 3 | 2.3% | 2.3% | 0.7% | 1.6% | 1.6% |

| Asset 4 | 2.1% | 2.1% | 0.7% | 1.4% | 1.4% |

| Asset 5 | 2.5% | 2.2% | 0.7% | 1.8% | 1.5% |

| Mean return | 2.23% | 2.17% | |||

| SD | 18.5% | 10.5% | |||

| Avg. excess return | 1.5% | 1.4% | |||

| SR | 0.08 | 0.14 | |||

| Change in SD | (43.3)% | ||||

| Change in SR | 69.2% | ||||

Green Transformation: Realising alpha with Implenia

Compared to regular capex and maintenance schedules within real estate portfolios, the pressure created by ESG actually provides an opportunity to accelerate value creation with the help of skilled and experienced partners like Implenia, who can further exploit potential manufactured alpha – especially in the context of stranded assets and value-add properties. This can be achieved through customised “Destrandification”-strategies and tailored ESG solutions that significantly mitigate portfolio risk while unlocking future value appreciation, therefore enhancing total and risk-adjusted returns.

Pension funds in Switzerland are particularly exposed because they are underinvested in sustainable real estate (10-40% of their total real estate portfolio), and because a significant number of funds already exceed the maximum real estate quota of 30%. A systemic strategic approach is essential to identify stranded assets, create value within the portfolio and identify main value drivers to improve transparency and speed, but also to support price mechanisms with divesting considerations.

Market participants can benefit immensely from Implenia's wide-ranging services and extensive experience in repositioning underutilised properties and executing sustainable renovations.

The Group has a comprehensive track record of effectively managing and converting properties from environmentally harmful states to sustainable ones. We provide support to property owners and investors on technical and investment-related issues, offering tailored solutions to improve the sustainability performance, long-term profitability, and adaptability of real estate portfolios.

Your contact

How to take the path to Net Zero carbon buildings

Net Zero White Paper

The exponential increase in anthropogenic greenhouse gas concentrations since industrialization is leading to an enhanced greenhouse effect. As a result, irreversible damage is being done to natural ecosystems and to our society. Based on this realization, the decarbonization approach has to become the focus of real estate development and construction.

Our research and the resulting decarbonization white paper provides you with all the necessary insights and information on this future-oriented and relevant topic. The data basis of the white paper consists of a broad portfolio study of 36 Implenia development projects based on SIA 2040, which was carried out in 2022.

Sources

- Energy Performance of Buildings Directive

- Energy Efficiency Directive

- Stranded Asset Risk Grips Real Estate Investors: ESG Regulation

- Stranded Assets: Büros für 303 Milliarden Euro gefährdet

- Bis zu 69 % der Büroimmobilien von Veralterung bedroht

- Report Obsoleszenzrisiken

- Langfristige Klimastrategie 2050

- Stranded assets

- The Hierarchy of Alpha

Comments (0)

No comments found.