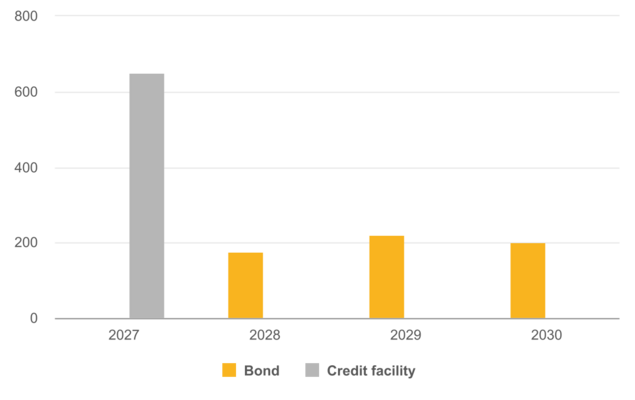

Financing instruments and maturity profile

Creditor relations

Implenia ensures financial flexibility by using a wide range of financial instruments and securing a well-balanced maturity profile.

Our long-term debt consists mainly of bonds in Swiss Francs

In addition, Implenia uses a syndicated facility agreement with a Swiss syndicate providing revolving credit facilities in Swiss Franc. For short-term financing needs, we can use the revolving credit facility as well as bilateral credit facilities.

Maturity profile of debt financing instruments

as at 25.9.2025

Outstanding bonds

Implenia AG issued and listed the following bonds on the SIX Swiss Exchange:

| Coupon | Term | Nominal | Issue price | Due | ISIN code |

| 1,000% | 2016-2026 | CHF 125 Mio. | 100,74% | 20.3.2026 | CH0316994661 |

| 3,000% | 2024-2028 | CHF 175 Mio. | 100,00% | 17.5.2028 | CH1344316687 |

| 2,500% | 2025-2029 | CHF 220 Mio. | 100,00% | 30.4.2029 | CH1428867134 |

| 2,050% | 2025-2030 | CHF 200 Mio. | 100.082% | 3.10.2030 | CH1485827047 |

Bond credit ratings / Analysts

The outlined ratings comply with banking internal criteria. Please note that all credit ratings are subject to revision at any time. We make no claim that below list is complete or up-to-date. The evaluations, judgments and expectations do not necessarily reflect the opinion of Implenia AG or its management. (Updated: 11.9.2025)

| Rating agency/Bank Rating | Rating | Outlook | Analyst | Phone | |

|---|---|---|---|---|---|

| UBS | BBB- | stable | Alexandra Bossert | +41 44 234 47 95 | Contact |

| Zürcher Kantonalbank | BB+ | positive | Holger Frisch | +41 44 292 33 37 | Contact |

| Fedafin | not published | not published | Peter Gasser | +41 71 552 32 10 | Contact |

| Independent Credit View | not published | not published | Marc Meili | +41 43 204 19 19 | Contact |

Please contact the respective analyst directly if you wish to receive a copy of a bond rating report.

Syndicated Facility Agreement

Implenia has a syndicated credit agreement totalling CHF 650 million. The unsecured credit agreement consists of a CHF 100 million tranche (Facility A) as a revolving cash limit, a CHF 250 million guarantee limit (Facility B) and a CHF 300 million cash and/or guarantee limit (Facility C). The term runs until 31 December 2027.