Study: Sustainability as a decisive investment criterion for institutional investors

The sustainability megatrend has a strong impact on the real estate markets and on the portfolio allocations of institutional investors. With their existing properties, they are facing major challenges with regard to the transformation towards a sustainable real estate portfolio in order to avoid stranded assets1, driven on the one hand by increasing regulatory pressure and on the other hand by growing pressure from valuers who are increasingly using sustainable properties as benchmarks. This is resulting in a disruptive rethink in the industry and in real estate valuations - away from "green premiums", a revaluation for sustainable properties, and towards "brown discounts", a devaluation for properties that do not meet relevant sustainability requirements.

Irma Kessler, Consultant Real Estate Investment & Strategy, gets to the bottom of this phenomenon in her study "Sustainability and infrastructure in real estate portfolios". The study was conducted in 2022 in cooperation with Lucerne University of Applied Sciences and Arts and the Swiss Pension Fund Association ASIP and published by Springer Gabler. It provides valuable insights into the real estate-specific investment behavior of selected institutional investors in Switzerland and sheds light on current and future management challenges, trends and solutions in connection with investments in sustainable real estate.

"A brown discount poses a serious threat to the risk/return profile of institutional investors."

Irma Kessler

Consultant Real Estate Investment & Strategy

Swiss pension schemes and pension funds represent the dominant group of investors in the sample examined, followed by investment foundations and sFund companies, family offices and a reinsurance company.

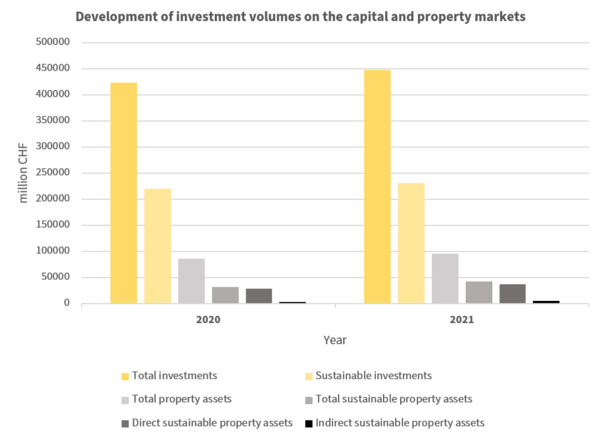

Investments in sustainable real estate show the strongest development

Compared to the previous year, the investment volumes for 2021 show a very positive trend on both the capital and real estate markets. Similarly, the strongest development in 2021 was seen in investments in sustainable real estate, with an increase of 33% to CHF 43 billion.

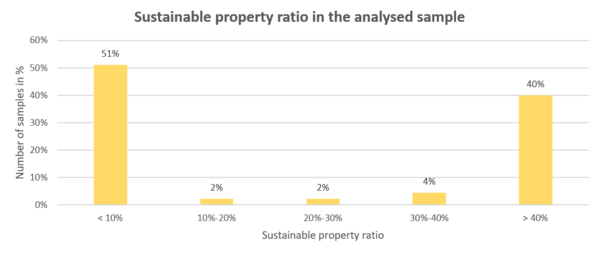

Small and medium-sized pension funds have some catching up to do

Small to medium-sized pension funds in particular (assets up to CHF 500 million) show great potential for optimization: at the time of the study, less than 10% of their total real estate assets were invested in sustainable real estate. In contrast, larger pension funds (assets of CHF 500 million or more) play a pioneering role, with a sustainable real estate ratio of over 40%.

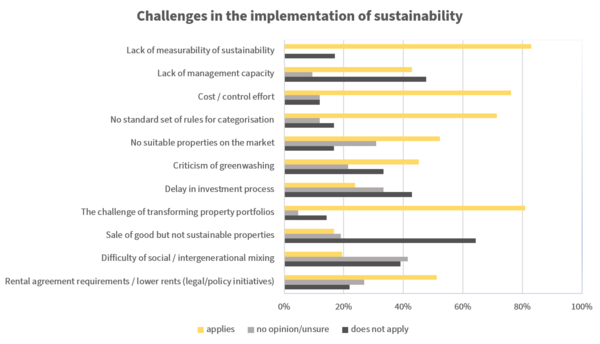

Implementing sustainability in the real estate portfolio is a challenge

The main challenges in implementing sustainability in the real estate portfolio lie in the lack of measurability of sustainability KPIs and in the holistic transformation of an existing portfolio. The latter can be addressed, for example, with a focus on "hold and refurbish" and increased investment in revitalized or repositioned core/core-plus2 properties as well as in sustainable new construction projects.

Institutional investors have begun to streamline their portfolios by selling stranded assets in order to curb the gradually increasing brown discounts in the real estate portfolio. Ultimately, it is not only sustainability per se that gives rise to restructuring, but also the optimization of the risk/return profile in the real estate portfolio.

Reposition or sell?

A key question facing institutional investors in the context of portfolio optimization is whether they should invest in existing properties with the aim of energy-efficient refurbishment, revitalization or repositioning, or whether divestment, i.e. the sale of stranded assets or brownfields3, is more expedient. Swiss pension funds in particular are confronted with this, as they have exhausted their real estate quota and the majority of them are above the prescribed maximum value of 30% - an all the more explosive circumstance in light of the fact that the majority of investors within the observed sample have less than 10% of their total real estate assets invested in sustainable real estate.

The transformation succeeds with strong partners

The challenges facing institutional investors are as numerous as they are diverse, and their complexity underlines the importance of strategic partnerships.

"For us, sustainability is a task, a competitive factor and a driver of innovation all in one. The strategic partnership with Implenia helps us to meet our high sustainability standards."

Marc Pointet

CEO Ina Invest

With its comprehensive, integrated range of services and its expertise in the field of sustainability, Implenia is well positioned and has an impressive track record in the management and transformation of real estate "from brown to green". We support owners and investors in both technical and investment-specific issues and develop specialized solutions for the transformation of real estate portfolios to achieve the best possible sustainability performance, long-term profitability and flexibility of use.

We are demonstrating our specialization in the redevelopment of existing properties and the development of effective "destrandification" strategies at Rue du Valais in Geneva, for example: in a prime location, we are transforming a building currently used exclusively for offices into a majority residential use, in partnership with the owner Ina Invest, which acquired the property as a stranded asset with the intention of repositioning it.

The strategic planning has shown that in the "demolition and new construction" scenario, construction emissions per year can be reduced by -30% from 9kg CO2/m2 to 6.3 kg CO2/m2 and operating emissions per year can be reduced by -82% from 35kg CO2/m2 to 4.1 9kg CO2/m2.

In dialog for the solutions of tomorrow

As smart adaptors in the changing real estate industry, the specialists in the Real Estate division are committed to open dialog with all market participants. For example, Reimer Siegert, Global Head Real Estate Investment, and Irma Kessler speak every year at the "Real Estate Investment and Asset Management" conference at Lucerne University of Applied Sciences and Arts about current practical examples and share the latest findings. Last year, the focus was on issues such as the contribution that NAV-based indirect sustainable real estate investments can make to achieving real estate-specific sustainability goals and the opportunities that "asset swaps"4 can offer as a solution for stranded assets.

In an RICS webinar on "From real estate impact development to real estate impact investment", Reimer Siegert and Irma Kessler presented various case studies on Implenia's sustainability strategy and its implementation at the level of new construction and revitalization/repositioning, including the new construction project "Green Village" in Geneva and the repositioning project "Rue du Valais".

There will be an update on both formats in spring/summer 2024, during which the Real Estate Investment team will share its latest findings and experiences. We look forward to a lively exchange:

Upcoming events on this topic

Wednesday, May 15, 2024

HSLU Conference "Real Estate Investment and Asset Management" 2024

Register now

Wednesday, July 3, 2024

RICS / HSLU Webinar "Unlocking Investment Potential"

Register now

Your contact

Alternatively, the business card is available for download. Download VCF-Card

Glossary

- Stranded assets

Properties that no longer meet the increasing sustainability requirements or stricter regulations are gradually reduced in value to the point where they become unsaleable and are therefore "stranded" in the portfolio. They become so-called "stranded assets". - Core/core-plus

The term "core" refers to a risk class in the real estate industry that has the lowest probability of default compared to other risk classes for investors. Core properties are mature but high-quality existing properties and new developments in good to very good A locations that are characterized by high property quality and predictable cash flows. "Core-plus" describes a risk class that has a moderate risk with relatively low expected returns. Core-plus properties are usually in B locations with potential and therefore offer development opportunities. - Brownfields

Brownfields are properties on which buildings or other structures already exist or have existed. As a rule, these are disused industrial sites. - Asset swaps

Asset swaps refer to the exchange of directly held properties for participation rights in a real estate investment vehicle (contribution in kind). Pension funds, for example, can transfer their direct investments to an investment foundation or investment group in a tax-neutral manner and receive participation rights in return.

Comments (0)

No comments found.