Business report

Assessment of market environment and forecast

The world economy remains in good shape and this will have a positive influence on activity in the construction sector. We will continue to see overall economic growth, though this will be somewhat weaker than in previous years. We expect the strongest growth within the construction sector to come in civil engineering.

The construction industry in international context

The world economy has lost some traction. This can be seen, for example, in the downward trajectory of demand in G20 countries, which has resulted not least from trade conflicts between the major economic powers. Overall, however, the world economy remains stable: inflation is still moderate, and interest rates are low.

Factors that are helping to support the construction industry include demographic trends, attractive financing terms, tax incentives and underlying economic growth. Business volumes in most markets and segments will remain positive.

The construction industry in Switzerland

The Swiss economy as a whole has lost some of its momentum, not least because of the strong Swiss franc and the effect this has on exports. In recent years the construction sector has consistently bolstered the Swiss economy with stable growth rates. The onset of overcapacities and vacancies in the residential market is now slowing investment down, though this trend is counterbalanced by solid capital spending on infrastructure. Consequently, we are seeing a structural change. Residential construction has been the main engine of rising investment in the construction sector for many years, but now civil engineering is increasingly taking over this role. This trend is being driven primarily by government investment in roads and railways. However, demand for residential property is still strong in good locations within urban centres, thanks in part to the positive effect of attractive financing conditions.

Trends in the non-residential sector remain solid in spite of the cooling economic environment. Expected investments in healthcare, and by pharmaceutical and biotech companies are the main growth drivers here.

Construction industry in Germany

The German economy has weakened after a period of strong growth rates, but is already set to stabilise again in 2020. Construction volume continues to grow due to rising construction costs, higher required standards of insulation and fire protection, and shortages of suitable land and skilled employees, though this growth is a little slower than in recent years. In the longer term, however, changing age structures, technological progress and the energy transition will drive construction activity and, therefore, growth in the industry.

The main sources of stimulus in the residential construction market are rising incomes, low interest rates and the increased housing demand generated by urbanisation and immigration. However, capacities are largely exhausted, which is driving construction costs up. Building Information Modeling and modular, prefabricated construction methods offer potential for efficiency gains. In the non-residential sector, healthcare is driving demand, particularly because of demographic change.

Civil Engineering depends very much on the propensity of the public sector to invest. Investment levels remain high in the transport sector. Demand is stable in road construction. Growth is expected to weaken in the utilities sector and in infrastructure for energy and telecommunications.

Construction industry in Sweden and Norway

Sweden and Norway are still making up for the lack of capital spending caused by the financial crisis of the 1990s. There are various government programmes underway and, given population growth in these countries, these are likely to continue.

Civil engineering is the driving force in the construction industry in both countries. In addition to the programmes already mentioned, there are numerous short-term initiatives in play. Local authorities are also able to source half the funding they need for public transport infrastructure projects from central government. Road and rail construction are the main drivers here. New investment is clearly playing a much more significant role than maintenance and repair. In the utilities sector, efforts to modernise power stations and power grids are being driven by slightly higher electricity prices and climate change.

Construction industry in Austria

Residential construction has long been a growth driver for the Austrian construction industry, but factors such as steadily slowing population growth and rising land prices are set to dampen this effect from 2020 onwards. There is also a trend away from new construction and towards modernisation. Demand in the non-residential sector will increase, mainly because of the rise in demand in the healthcare industry as the population ages.

Investment within the civil engineering sector, especially in the railway network, has benefited from the higher tax revenues and low budget deficits of recent years. This will largely stop, though much of the slack will be taken up by stable road construction activity.

Construction industry in France

The French economy as a whole will continue to enjoy positive growth rates.

The civil engineering sector in France has grown strongly, mainly because of large transport infrastructure projects. This has led to lively activity, high employment and well-filled order books. Continued healthy growth is expected in the civil engineering sector, though the emphasis will shift from road to rail. The government has announced that it wants to improve the situation significantly in terms of passengers, the track network and freight. In the longer term, the recently adopted Mobility Orientation Law will provide new impetus by enshrining the goal of a comprehensive mobility network in legislation.

Good conditions for Implenia to grow

With our good operating performance in 2019 we are well positioned in all our home markets and in the segments where Implenia is active. Continuing solid growth in demand for the real estate and construction services we provide in our home markets is a good foundation for profitable growth at all our divisions – Development, Buildings, Civil Engineering and Specialties. Geographically and along the value chain, we position our businesses so that they can help shape future changes in the construction industry. In the long term, we are aligning our activities to the following megatrends, which will fundamentally change our customers’ needs and demands:

- Urbanisation: 70% of the world’s population will live in cities by 2050. The resulting densification will require new housing concepts that can be adapted flexibly to residents’ differing lifestyles and life phases.

- Mobility: This is hugely important in our globalised society. The way people want to move around will become increasingly individualised and complex; but at the same time we have to be careful about our use of natural resources. Mobility infrastructure has to be designed and built accordingly.

- Connectivity: Society is connected, and many everyday actions and transactions are done via digital platforms. Spatial boundaries are dissolving, sharing concepts are coming to the fore. And despite digitalization, people still want social spaces nearby where they can interact in person with others.

- Individualisation: Self-determination is a priority across all generations. Personal life plans and needs are influencing what people want in terms of residential and work spaces, as well as mobility.

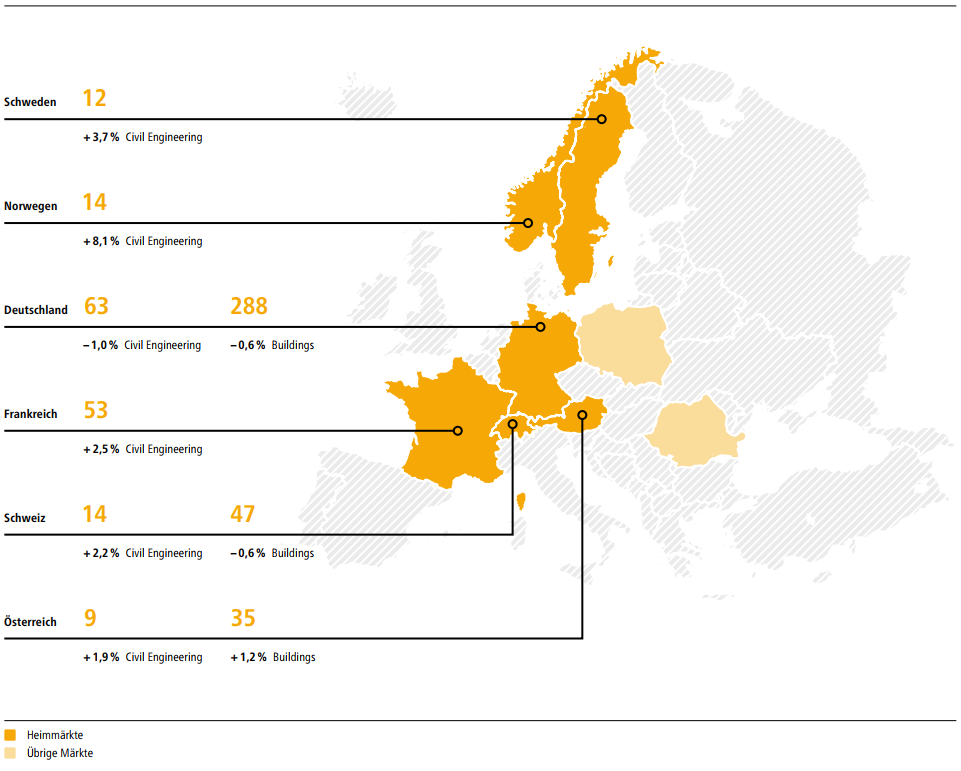

Sustainable investment in our home markets

in EUR bn

Our assessments of market conditions and our forecasts are based on data and insights from Euroconstruct.

This data refers to segments of the construction industry, which Euroconstruct defines as follows:

−Residential: permanent residences and second homes owned by households

−Non-Residential: all buildings that are not intended as dwellings; this includes commercial buildings used as temporary places of residence, i.e. hotels, nursing facilities, etc.

− Civil Engineering: Transport and utility infrastructure