Business report

Market outlook remains positive

An initially positive growth outlook for the European economy in 2020 was upended by the COVID-19 pandemic: the International Monetary Fund (IMF) has estimated growth of –7.2% for the European economy last year. In 2021, by contrast, there should be clear signs of a recovery, with forecast growth of 4.7%.

Our assessments of market conditions and our forecasts are based on data and insights from Euroconstruct.

This data is based on Euroconstruct’s segmentation of the construction sector, which is as follows:

- Residential: permanent residences and second homes owned by households

- Non-residential: all buildings that are not intended as dwellings; this includes commercial buildings used as temporary places of residence, i.e. hotels, nursing facilities, etc.

- Civil engineering: Transport and utility infrastructure

Construction industry in Europe

Prospects for the European construction industry in 2020 were initially positive, but then COVID-19 arrived, hurting both the supply side (e.g. bottlenecks on our construction sites) and the demand side (e.g. lower purchasing power and postponed orders). But 2020 also showed that the construction industry is more stable than many other sectors. Demographic effects, attractive financing conditions and various measures taken by governments, including tax incentives, continue to work in the industry’s favour. Not least because of the pandemic, people are looking for attractive places to live, while in many countries there is a need to renew or upgrade transport and utility infrastructure. And, in the longer term, the megatrends of urbanisation, mobility and infrastructure investment are also fuelling demand for construction services.

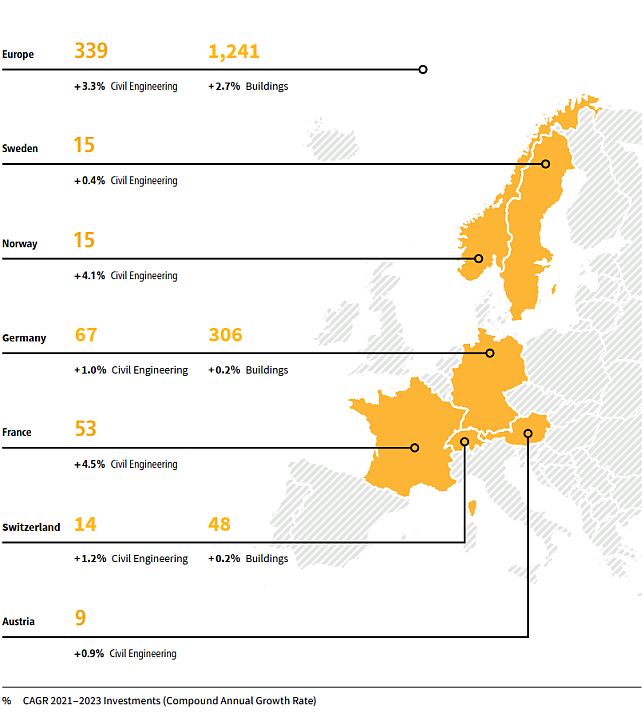

Overall, therefore, the market outlook for the European construction industry remains positive. The brakes were slammed on by the COVID-19 pandemic in 2020, but the expectation is that overall construction output in the EC-15 countries will stabilise, with growth rates of +4.5% in 2021, +3.4% in 2022 and +2.3% in 2023. According to Euroconstruct, the market outlook for civil engineering is healthy thanks to expected economic stimulus packages and an investment backlog in the infrastructure sector.

Prospects in Switzerland

The Swiss economy as a whole had already lost some of its momentum in 2019. This had the expected negative impact on construction in 2020, which was then exacerbated by the pandemic-related decline in investment (-2%). A recovery from this situation is expected in 2021, with investment rising slowly but steadily until 2023.

Investment in the residential sector should remain stable until 2023 following a 3.4% decline in 2020. In the longer term, the experience of the pandemic is likely to drive a trend towards larger and more attractive homes, while financing conditions are expected to remain favourable.

Meanwhile, after a fall of almost 1% in 2020, investment in the non-residential sector is likely to recover by about the same amount in 2021, and then stabilise with slight growth until 2023.

Civil engineering is undoubtedly the strongest sector, with the greatest volumes and the highest expected growth up to 2023. This trend is being driven particularly by the renewal of infrastructure. The Swiss government’s two infrastructure funds – the BIF rail infrastructure fund and the NAF national road and urban transport fund – are proving a great boon to the construction industry, particularly since they make funding for key civil engineering projects largely independent of the current budget situation.

Construction industry in Germany

Euroconstruct suggests that COVID-19 also clouded the outlook for the German market. Thankfully, though, pandemic-related restrictions only had a minimal impact on the operation of construction sites. This trend will continue in 2021.

The residential construction sector in Germany was less troubled by the effects of the COVID-19 pandemic than other European countries, and the project pipeline is well filled. Housing shortages, especially in urban centres, are also shoring up demand. This sector shrank slightly in 2020 but is expected to grow again in 2021 and then level off in the medium term.

Demand in the non-residential sector is dominated by private investors. Volumes in this sector will decrease slightly overall in the 2020/2021 period. A lot of construction projects have already successfully passed the approval process, however, so we expect non-residential to make up at least half this decline by 2023.

As in the residential sector, civil engineering volumes are initially set to decrease somewhat in 2020 and 2021. In road construction there will be more renovation than new works, while rail construction will continue to see high demand for modernisation. Investment in expansion and new works will then rise again in the medium term. In the long term, starting in 2022, the civil engineering sector will recover strongly and become the main driving force of the construction industry in Germany too.

Complex infrastructure projects in Europe

In the other European markets (Sweden, Norway, France and Austria), Implenia will focus strictly on large, complex tunnelling and related infrastructure projects. With our expertise and experience in planning, coordinating and implementing complex infrastructure projects, we can continue to position ourselves extremely effectively in these markets. The transport sector has been heavily affected by the pandemic, but is expected to recover significantly in the medium term. Additionally, digitalization opens up new potential that has only increased as a result of the effects of COVID-19 on social and working life. For example, 5G mobile technology and the rise in “mobile working” will continue to drive demand for telecommunications and networking infrastructure.

Good conditions for Implenia to grow

The longer-term megatrends that reflect the major changes in the way people live remain relevant despite the COVID-19 pandemic. Consequently, Implenia will not only be continuing with its new strategy, but will be focussing its activities, business areas and markets even more intently. As an integrated real estate and construction services provider in an industry that will get through the pandemic and its after-effects more robustly than many others, we are very well placed to realise our existing and new potential.

- URBANISATION By 2025, 81.2% of Western Europe’s population1 will live in urban regions (84.6% by 2040). The resulting densification requires new housing concepts that can be adapted flexibly to residents’ different lifestyles and phases of life, and that are designed to be environmentally, financially and socially sustainable.

- MOBILITY AND INFRASTRUCTURE INVESTMENT By 2040, there will have to be EUR 10.7 trillion of investment in mobility and infrastructure2 within Europe. The way people want to move around will become increasingly individualised and complex; but this will have to go hand in hand with careful use of natural resources. Mobility infrastructure has to be designed and built accordingly. In addition to demand-side mega-trends, the construction industry itself will also see significant changes over the next few years. Economies of scale, risk diversification and investments in innovation will gain in importance as the industry undergoes consolidation and internationalisation. Prefabrication of modules in factories is speeding up the ongoing industrialisation of the construction industry and raising productivity. Digitalization is improving and simplifying construction planning and processes – through end-to-end use of Building Information Modeling (BIM), for example, or through the application of digital Lean Construction methods and Integrated Project Delivery (IPD). Due to increasing demand from investors and project owners, as well as through the efforts of construction companies themselves, the trend towards environmentally and socially sustainable building solutions will continue to increase.

1 United Nations World Urbanization Prospects

2 Estimate by Oxford Economics

Sustainable investments in markets relevant to Implenia in EUR billion