Market and customers

In brief

Implenia is ideally positioned in a comparatively stable market environment to:

- Exploit the potential for profitable growth of its core markets Switzerland and Germany, as well as that of other markets in the civil engineering sector

- Offer the services customers want in each market

- Strengthen and expand its market position

- Use its expertise and experience to meet customer needs

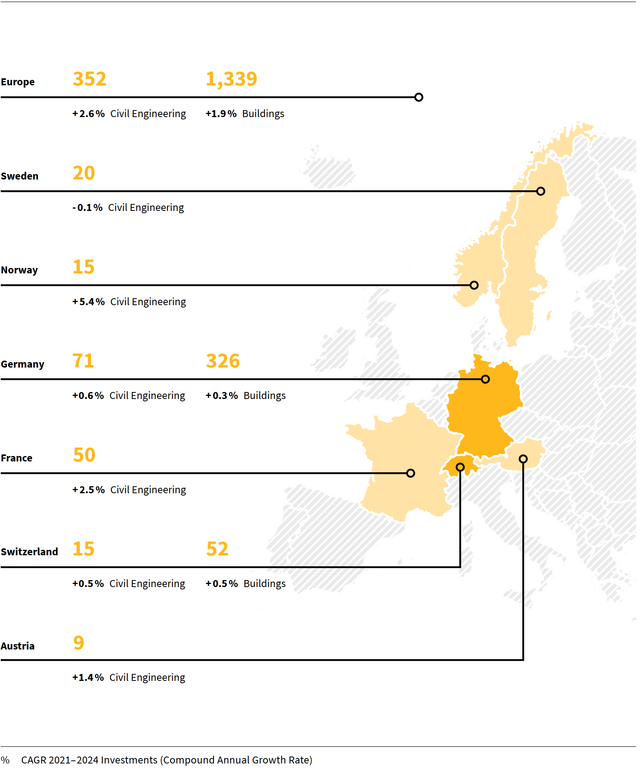

Construction industry in Europe

Investment in real estate and infrastructure construction accelerated sharply in 2021 thanks to the international economic recovery, fiscal policy support for infrastructure investment, incentives for building renovation, low mortgage rates and rising housing prices. This was despite uncertainties caused by the pandemic and rising prices for construction materials. The outlook for the growth of construction output in Europe (EC-15 countries) is very robust. Growth in construction output in the building construction sector (CAGR 2021–2024) is forecast to be +1.9%, and in infrastructure construction + 2.6%.

Prospects for core market Switzerland

Housing investment in Switzerland is forecast to rise slightly (+ 0.2%) in 2022. Non-residential construction is being supported by the general economic recovery and the impulses delivered by significant investments in health, pharmaceutical and educational buildings. Growth expectations for this sector are 1.6% for 2022, 2.1% for 2023 and 1.0% for 2024. The civil engineering sector is mainly driven by public investment in complex transport infrastructure projects. These are financed through two large federal infrastructure funds. Civil engineering is expected to grow moderately for the next three years (2022: 0.5%, 2023: 0.4%, 2024: 0.7%), with much of this growth accounted for by a solid level of investment in transport infrastructure.

Prospects for core market Germany

Factors inhibiting investment in residential construction should subside in 2022 while positive effects, such as continued large catch-up demand for housing production and low interest rates, should have their effect. The very full project pipeline should stabilise construction activity in the medium term.

New construction of non-residential buildings is being driven mainly by private-sector demand. Growth (CAGR 2021–2024) of + 0.3% is expected for the building construction sector.

Civil engineering is dominated by the public sector, which has greatly expanded its transport construction activities since 2016. The federal states have to submit a balanced budget again from 2023 (the so-called debt brake is suspended until then), meaning they will have to control their expenditure more carefully; but the federal government has more leeway. According to its medium-term financial plans, it will keep its investment spending on roads, railways and waterways at the current level. The civil engineering sector is forecast to grow by 0.6% (CAGR 2021–2024).

Market assessments and forecasts are based on data and insights from Euroconstruct.

This data is based on Euroconstruct’s segmentation of the construction sector, which is as follows:

− Residential: permanent residences and second homes occupied by households

− Non-residential: all buildings that are not intended as dwellings; this includes commercial buildings offering time-limited accommodation, e.g. hotels and care homes.

− Civil engineering: transport and utility infrastructure

Complex infrastructure projects

In the other European markets Implenia’s expertise in tunnel construction and related infrastructure make it a sought-after partner for complex large-scale projects. In France, further significant growth rates are expected for the civil engineering sector in 2022 thanks to fiscal stimulus measures by the government. Norway is currently experiencing an investment boom in infrastructure projects, which is likely to result in overall annual growth of between 12% and 14% in 2022. In Sweden, too, favourable financing conditions and a backlog of maintenance and repair work are driving demand. Civil engineering remained relatively stable in Austria during the pandemic. We expect investment there to grow slowly but steadily.

Significance for Implenia

With its comprehensive, integrated range of services across all four Divisions, Implenia is excellently positioned as a construction and real estate service provider in its core markets of Switzerland and Germany. In Germany, in particular, where market share is still lower, there is considerable growth potential for Division Buildings – with its focus on large, complex projects and partnership-based contract models – as well as for Division Real Estate, with its activities in real estate development and its newly founded joint venture Rubus. Implenia will continue to expand its capabilities in the higher-margin areas of consulting, planning and engineering in Switzerland and Germany, both organically and, if necessary, through suitable acquisitions.

The company will use its expertise and experience in tunnel construction and related infrastructure in other markets throughout Europe. Here, too, the focus is on large, complex projects in which specialised expertise and management skills can be optimally applied from a single source.

With its geographically streamlined, focused service portfolio, the Group is ready to use its strengths to meet customer requirements in all markets, gain market share and grow profitably.

Customer-oriented service structure

Implenia’s customer segments are very heterogeneous: They range from large B2B customers in the public sector and international corporations to broad B2C buyer groups in the market for owner-occupied apartments. Customer requirements are similarly varied. Implenia’s corporate values – excellence, collaboration, agility, integrity and sustainability – guide and shape every customer relationship. For Implenia, close collaboration as partners is the ultimate goal for all customer relationships. The services provided by each Division are structured to fit the requirements and opportunities of their customer segments as effectively as possible.

Implenia offers its customers an integrated range of consulting, development, planning and construction services for real estate and infrastructure in Switzerland and Germany. Implenia also offers tunnelling and related infrastructure projects in other markets.

- Real Estate Division Real Estate develops and sells Implenia’s own real estate portfolio as well as offering all the real estate services customers need to develop their own real estate portfolios. The Division’s services include Real Estate Development, Management, Investment and Products. At Real Estate Products, the Division is developing industrially manufactured, sustainable property products for green hospitality in a joint venture with Deutsche Seereederei (DSR). It also has a successful partnership with Ina Invest on acquisition, development and other real estate services, as well as execution. Major ongoing projects include Lokstadt in Winterthur, Green Village in Geneva, Unterfeld in Baar, Tivoli in Neuchâtel and newly acquired sites in Pully (CH), Darmstadt and Rüsselsheim (both DE).

- Buildings The customers at Division Buildings tend to be private companies, public sector institutions or other organisations with complex construction projects. These customers increasingly want Implenia to get involved in the project at an early stage based on new partnership-based collaborative and contractual models. Partnership models strengthen customer relationships and often lead to long-term cooperation across numerous projects. The Division’s customers also demand the highest standards in terms of quality, adherence to deadlines, safety and sustainability. There is attractive growth potential in buildings for the healthcare sector (e.g. cantonal hospitals in Aarau and Baden) and for the research and development sector (e.g. Empa, the Irchel Campus shared by the University of Zurich and ETH). With this in mind, Implenia has further expanded its market presence and expertise in these areas through the acquisition of BAM Swiss.

- Civil Engineering Division Civil Engineering’s customers are usually public sector institutions or the companies associated with them (federal government, cantons, federal states, railway companies, etc.). These customers value the Division as a specialist in large, complex tunnelling and infrastructure projects. On a regional level, Implenia is also in demand for complex large-scale engineering, road and rail construction projects, such as the Brugg bypass and the Liestal four-track expansion.

- Specialties This Division mainly works as a service provider for third-party customers, but also for Implenia’s other Divisions – with a focus on engineering and planning services. Customers particularly appreciate the services provided by BCL (construction logistics), which can make construction sites more efficient and sustainable. The Division also expects growing demand for Planovita (integrated digital building technology planning), Facade Technology and Timber Construction. Thanks to its wide variety of customer projects Implenia can evaluate ideas generated by its internal Innovation Hub at an early stage, in different phases and under real-life conditions.

Working with its customers, Implenia is creating and building the world of tomorrow – how we live, work and move in the future.

“We want to build as partners, because it simply makes more sense for everyone involved. If we can create trust, agree on common goals and find a good balance between the interests of all parties, the outcomes will ultimately be much better.”

Marc Bosch

Managing Director Wüstenrot Haus- und Städtebau GmbH, a customer of Division Buildings

Megatrends and changes in the construction

and real estate industry

Longer-term megatrends reflect significant changes in people’s needs.

URBANISATION By 2025, 81.2% of Western Europe’s population¹ will live in urban regions (84.6% by 2040). The resulting densification requires new housing concepts that can be adapted flexibly to residents’ different lifestyles and phases of life, and that are designed to be environmentally, financially and socially sustainable.

MOBILITY AND INFRASTRUCTURE INVESTMENT By 2040, there will have to be EUR 10.7 trillion of investment in mobility and infrastructure² within Europe. The way people want to move around will become increasingly individualised and complex; but this will have to go hand in hand with careful husbandry of natural resources. Mobility infrastructure has to be designed and built accordingly.

In addition to demand-side mega-trends, the construction industry itself will also see significant changes over the next few years. Economies of scale, risk diversification and investments in innovation will gain in importance as the industry undergoes consolidation and internationalisation. Prefabrication of modules in factories is speeding up the ongoing industrialisation of the construction industry and raising productivity. Digitalization is improving and simplifying construction planning and processes – through end-to-end use of Building Information Modeling (BIM), for example, and through the application of digital Lean Construction methods and Integrated Project Delivery (IPD). Due to increasing demand from investors and project owners, as well as through the efforts of construction companies themselves, the trend towards environmentally and socially sustainable building solutions will continue to increase.

1 United Nations World Urbanization Prospects

2 Estimate by Oxford Economics