Key figures for the Group

Consolidated key figures | ||||||||

in TCHF | 2021 | 2020 | Δ | Δ like for like1 | ||||

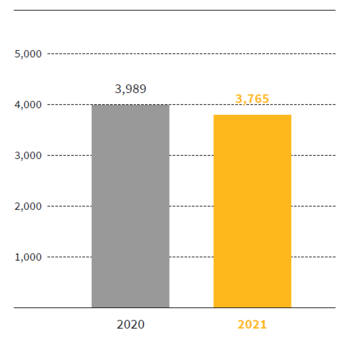

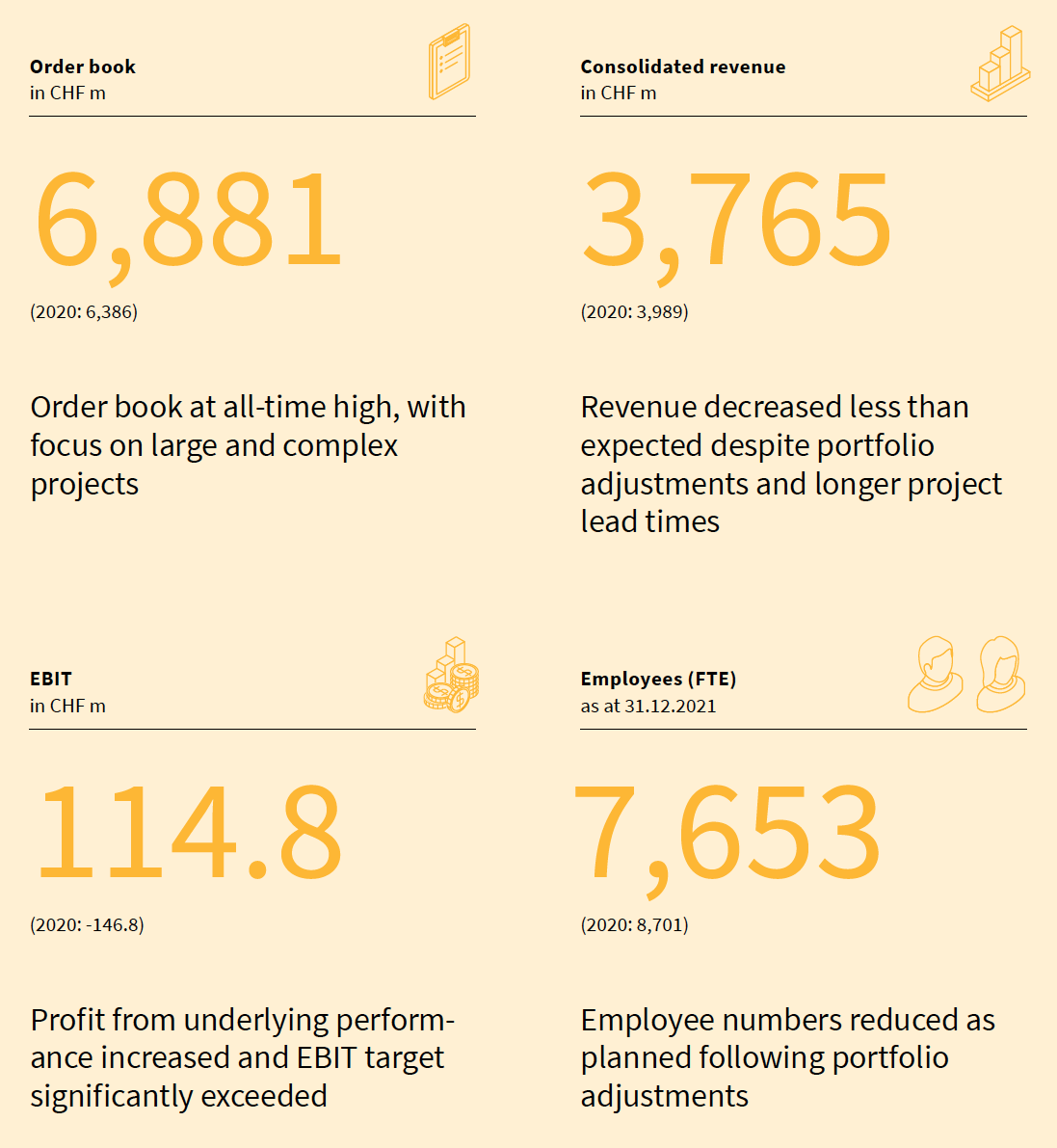

Consolidated revenue | 3,764,670 | 3,988,946 | (5.6 %) | (6.6 %) | ||||

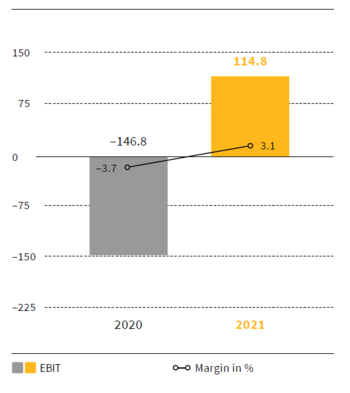

EBIT | 114,826 | (146,757) | ||||||

in % of consolidated revenue | 3.1 % | (3.7 %) | ||||||

Consolidated profit | 63,956 | (132,052) | ||||||

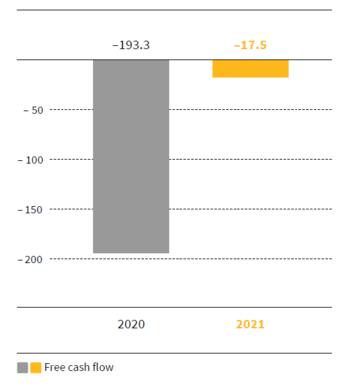

Free cash flow | (17,494) | (193,342) | ||||||

Net cash position excl. lease liabilities (as at 31.12.) | 67,319 | 160,526 | (58.1 %) | (51.8 %) | ||||

Net cash position (as at 31.12.) | (91,558) | (12,847) | 612.7 % | 561.3 % | ||||

Equity (as at 31.12.) | 345,918 | 303,027 | 14.2 % | 16.4 % | ||||

Order book (as at 31.12.) | 6,880,921 | 6,386,284 | 7.7 % | 10.5 % | ||||

Production output | 4,174,113 | 4,060,298 | 2.8 % | 1.9 % | ||||

Workforce (FTE; as at 31.12.) | 7,653 | 8,701 | (12.0 %) |

1 Foreign currency adjusted

Implenia improved underlying performance by 24% compared to previous year and significantly exceeded EBIT target of CHF >100 million with CHF 114.8 million

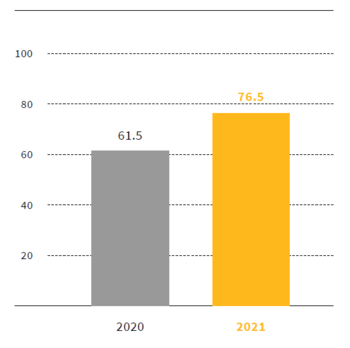

Implenia achieved reported EBIT of CHF 114.8 million (2020: CHF –146.8 million). All Divisions and relevant markets contributed positively to this result. Based on improvements by Divisions Buildings and Civil Engineering, the Group’s underlying performance at EBIT level increased by 24% to CHF 76.5 million (2020: CHF 61.5 million). The consistent execution of the transformation led to one-time effects of CHF 38.3 million, which had a positive impact on the result. Due to the strategic focus on large and complex projects, the order book increased to an all-time high of CHF 6,881 million (2020: CHF 6,386 million). Revenue decreased less than expected to CHF 3,765 million (2020: CHF 3,989 million) despite portfolio adjustments and longer project duration. By strictly applying Value Assurance, Implenia’s risk management, the Group ensures that the acquired projects are strategically relevant and have a significantly improved risk and margin profile. The pre-calculated gross margin has improved by over 1 percentage point since the introduction of Value Assurance. The net result amounted to CHF 64.0 million (2020: CHF -132.1 million).

Execution of transformation far advanced; strong and high-quality order intake

The execution of the transformation is far advanced. Implenia continues to focus on integrated construction and real estate services in Switzerland and Germany and offers tunnelling and related infrastructure projects in other markets. With a clear focus on profitable, complex projects, and by strictly applying Value Assurance, the Group was able to acquire several strategically relevant assignments with significantly improved risk and margin profiles in 2021. This shows that clients trust Implenia and that the company is well positioned with its expertise and experience along with its services and competencies. Meanwhile, Implenia adequately managed the impact of rising material costs by ensuring close cooperation between the operating units and the global procurement organisation.

Industry leader in sustainability; shaping digital construction

The company’s position as an industry leader in sustainability was confirmed in 2021 by significant environmental, social, and governance (ESG) rating agencies. MSCI raised Implenia’s rating to AAA, making it the first company in the MSCI Index Construction & Engineering to gain an AAA rating. Sustainalytics ranked Implenia as industry leader with 84 points for 2020 and EcoVadis awarded the group Silver status. Implenia is shaping industrialised, digitalized, and partnership-based development, planning, and construction services. Furthermore, the Group applies Lean Construction methods and BIM (Building Information Modeling) in all major projects and received various awards over the past two years.

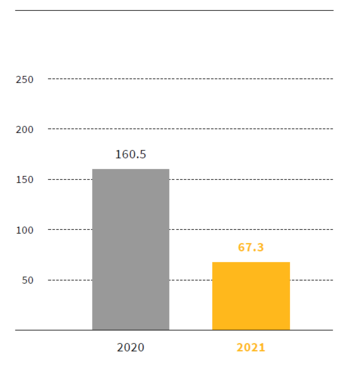

Equity strengthened; strong cash flow in second half of year; refinancing of maturing convertible bond secured

Implenia’s operational cash flow amounted to CHF – 69.2 million (2020: CHF –161.5 million) and free cash flow to CHF –17.5 million (2020: –193.3 million). In the second half of 2021, cash flow clearly showed a positive development. Implenia reported a net cash position of CHF 67.3 million as of 31 December 2021, excluding liabilities from leasing. In November, Implenia successfully issued a CHF 175 million bond, securing the full refinancing of the convertible bond ahead of its maturity in June 2022. The successful placement further strengthens the company’s financing structure and has improved the maturity profile of its capital market instruments.

Equity increased by 12% to CHF 345.9 million (2020: CHF 303.0 million). With CHF 2,988 million, total assets remained at previous year’s level (2020: CHF 2,943 million). The equity ratio was 11.6% (2020: 10.3%) as of 31 December 2021. Adjusted for the temporary effect of the CHF 175 million bond, the equity ratio stood at 12.3%. Reducing total assets, especially net working capital, remains a high priority for the Group. Implenia intends to achieve this mainly through an accelerated cash conversion cycle and the consistent implementation of the asset-light strategy. Implenia aims for an equity ratio of over 20% mid-term, based on an improved underlying business, including increasing earnings from services and expected dividends from participations. The equity ratio shall also be improved by potential outsourcing of further non-core businesses and asset-heavy activities.

Implenia aims for EBIT of more than CHF 120 million in 2022 from further improved underlying performance and a strengthening of the equity base by CHF >80 million

Implenia expects EBIT of more than CHF 120 million in 2022 resulting from further improved underlying performance. The estimated share of positive one-time effects from the transformation is less than 20%. Given the sustained improvement in profitability and the positive outlook for its core markets, Implenia is aiming mid-term for an EBIT margin of 3.5%. The ambition of an EBIT margin of 4.5% remains unchanged.

Board of Directors proposes to refrain from paying a dividend

As already announced in autumn 2021, Implenia intends to strengthen its equity by at least CHF 80 million in the current year. Consequently, the Board of Directors will propose to the Annual General Meeting of 29 March 2022 to refrain from paying a dividend.

Key balance sheet figures | ||||||

in TCHF | 31.12.2021 | 31.12.2020 | Δ | |||

Cash and cash equivalents and fixed short-term deposits | 796,895 | 719,990 | 10.7 % | |||

Real estate transactions | 149,269 | 137,130 | 8.9 % | |||

Other current assets | 1,136,534 | 1,093,712 | 3.9 % | |||

Non-current assets | 905,138 | 992,379 | (8.8 %) | |||

Total assets | 2,987,836 | 2,943,211 | 1.5 % | |||

Financial liabilities | 888,453 | 732,837 | 21.2 % | |||

Other liabilities | 1,753,465 | 1,907,347 | (8.1 %) | |||

Equity | 345,918 | 303,027 | 14.2 % | |||

Total equity and liabilities | 2,987,836 | 2,943,211 | 1.5 % | |||

Net cash position excl. lease liabilities (as at 31.12.) | 67,319 | 160,526 | (58.1 %) | |||

Investments in real estate transactions | 41,078 | 57,926 | (29.1 %) | |||

Investments in fixed assets | 42,653 | 52,106 | (18.1 %) | |||

Equity ratio | 11.6 % | 10.3 % |

EBIT | ||||||

in TCHF | 2021 | 2020 | Δ | |||

Real Estate | 42,133 | 109,408 | (61.5 %) | |||

Buildings | 32,352 | (19,236) | (268.2 %) | |||

Civil Engineering | 51,776 | (206,675) | (125.1 %) | |||

Specialties | 8,764 | (9,479) | (192.5 %) | |||

Functions | (20,200) | (20,775) | (2.8 %) | |||

EBIT Total | 114,826 | (146,757) | (178.2 %) |

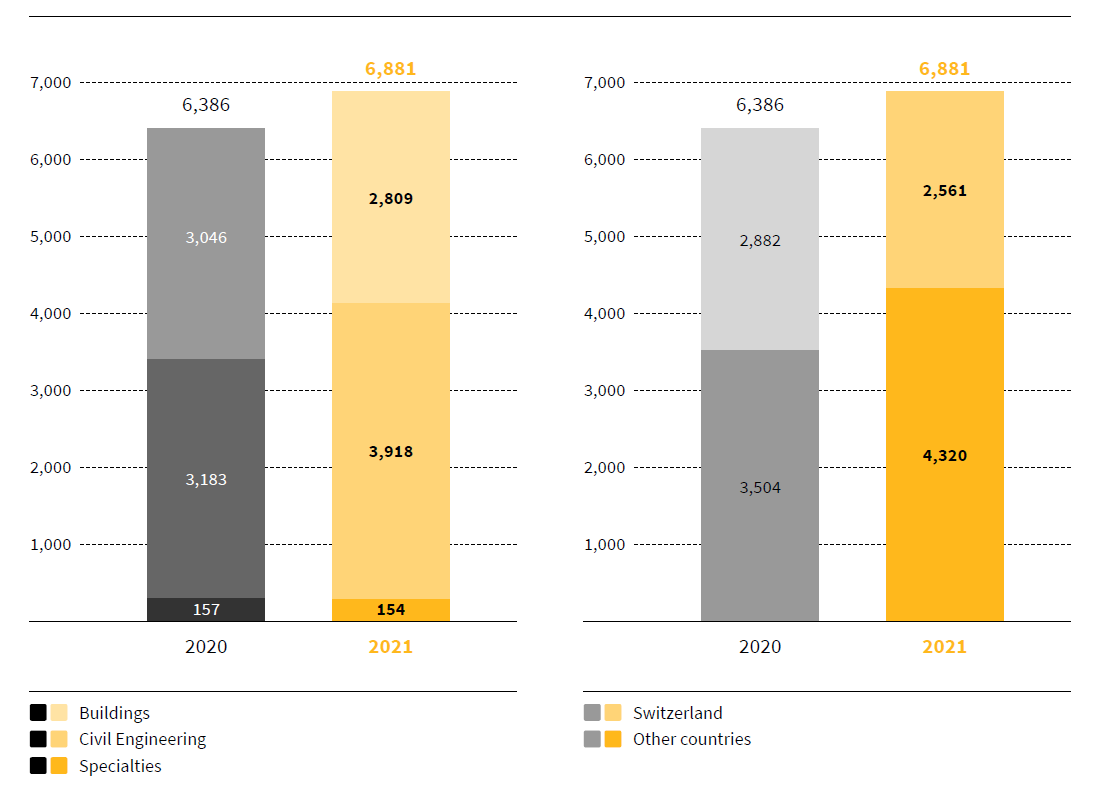

Order book

in CHF m

| Order book | ||||||

| in TCHF | 31.12.2021 | 31.12.2020 | Δ | |||

| Buildings | 2,809,189 | 3,046,474 | (7.8 %) | |||

| Civil Engineering | 3,918,114 | 3,183,202 | 23.1 % | |||

| Specialties | 153,618 | 156,607 | (1.9 %) | |||

Total order book | 6,880,921 | 6,386,284 | 7.7 % |

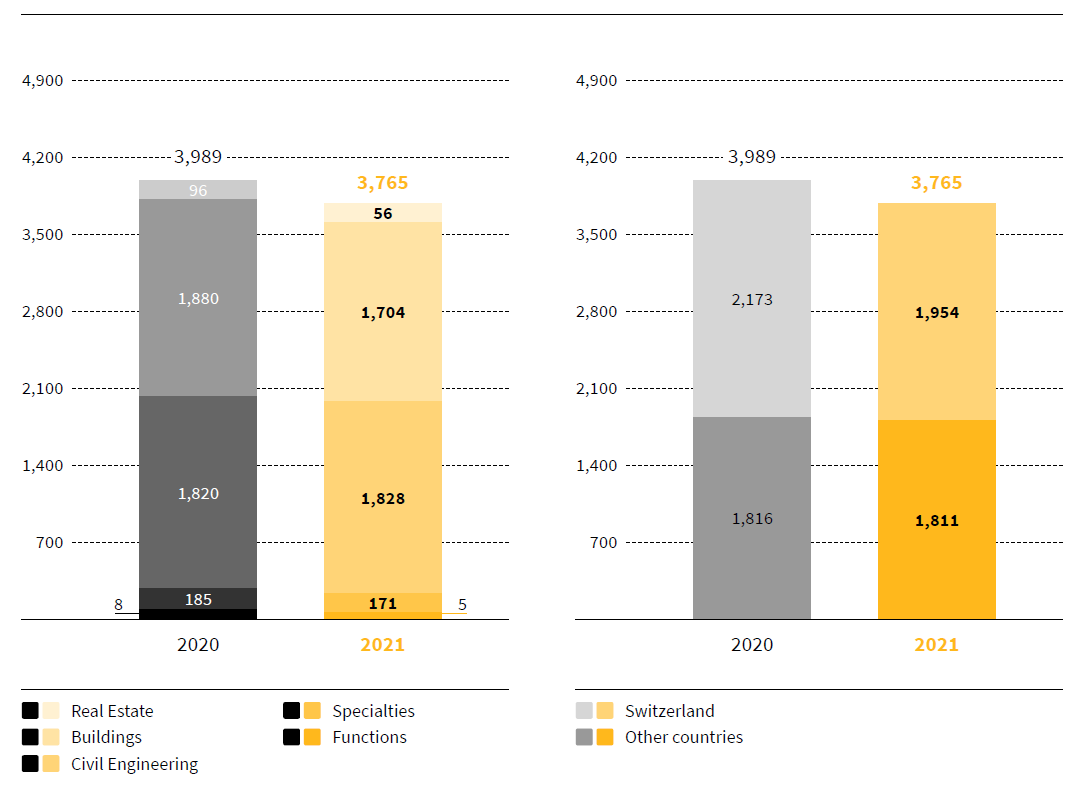

Consolidated Group revenue

in CHF m

| Consolidated revenue | ||||||

| in TCHF | 2021 | 2020 | Δ | |||

| Real Estate | 82,120 | 124,466 | (34.0 %) | |||

| Buildings | 1,818,760 | 2,079,821 | (12.6 %) | |||

| Civil Engineering | 2,060,672 | 2,012,855 | 2.4 % | |||

| Specialties | 208,583 | 223,628 | (6.7 %) | |||

| Functions / elimination of intra-group services | (405,465) | (451,824) | 10.3 % | |||

Total consolidated revenue | 3,764,670 | 3,988,946 | (5.6 %) |

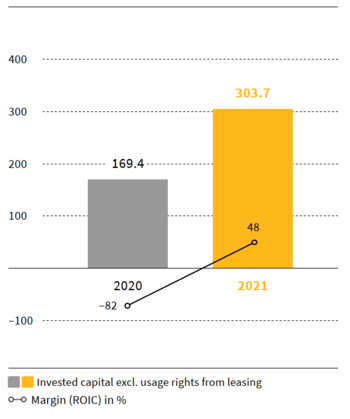

| Invested capital | ||||||

| in TCHF | 31.12.2021 | 31.12.2020 | Δ | |||

| Current assets (excl. cash and cash equivalents and fixed short-term deposits) | 1,285,803 | 1,230,843 | 4.5 % | |||

| Non-current assets (excl. pension assets and rights of use from leases) | 755,765 | 824,528 | (8.3 %) | |||

| Debt capital (excl. financial and pension liabilities) | (1,737,839) | (1,885,928) | (7.8 %) | |||

Total invested capital | 303,729 | 169,443 | 78.1 % | |||

| Rights of use from leases | 148,929 | 167,306 | (11.0 %) | |||

Total invested capital | 452,658 | 336,749 | 34.4 % |